Years ago, I started using Mint to aggragate my financial information. The idea made sense, like browser based Gmail made sense compared to using Outlook on the desktop. Mint seemed to be the first free service to connect with most financial institutions. Now there are many such services, and Mint has not managed to resolve any of the usability issues I have experienced all those years. I was about to look for alternatives today till I found a workaround for my latest annoyance: lack of bulk import.

Read more

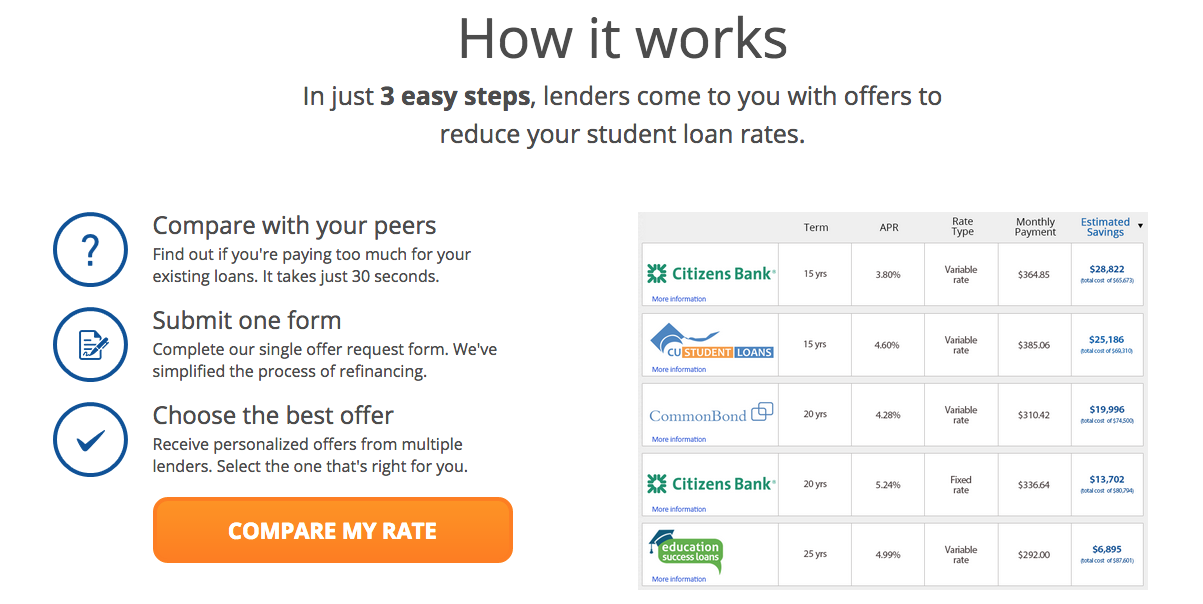

Back on February 19, about six weeks ago, I saw an ad on Facebook for Credible, a company that supposedly helps you consolidate private and government student loans. I had done a consolidation before through the sort of official Education Department route, but only some of my loans qualified, so I was still left with six loan accounts to deal with, ranging from 5 to 6.5 percent interest rates. For a few years they have been on auto pay, so it wasn’t a big deal, but the OCD me would prefer to see just one nice loan account instead of a bunch with weird payment amounts.

Credible claims to solve my “problem” with ease, in just three steps!

So I filled out the Credible sign up form and waited.

Read more

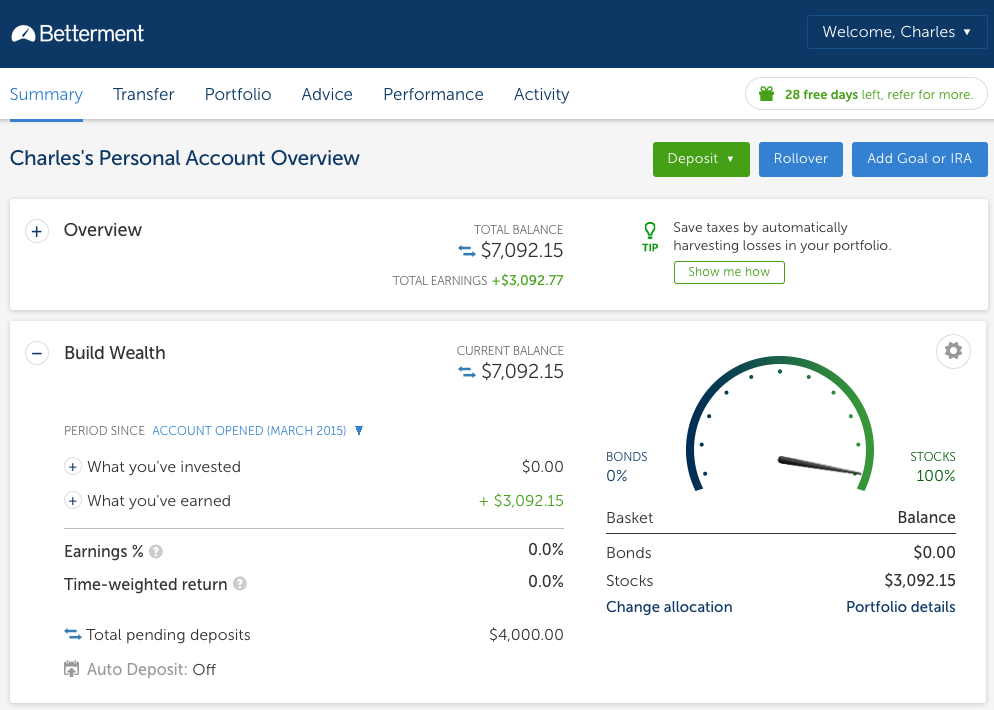

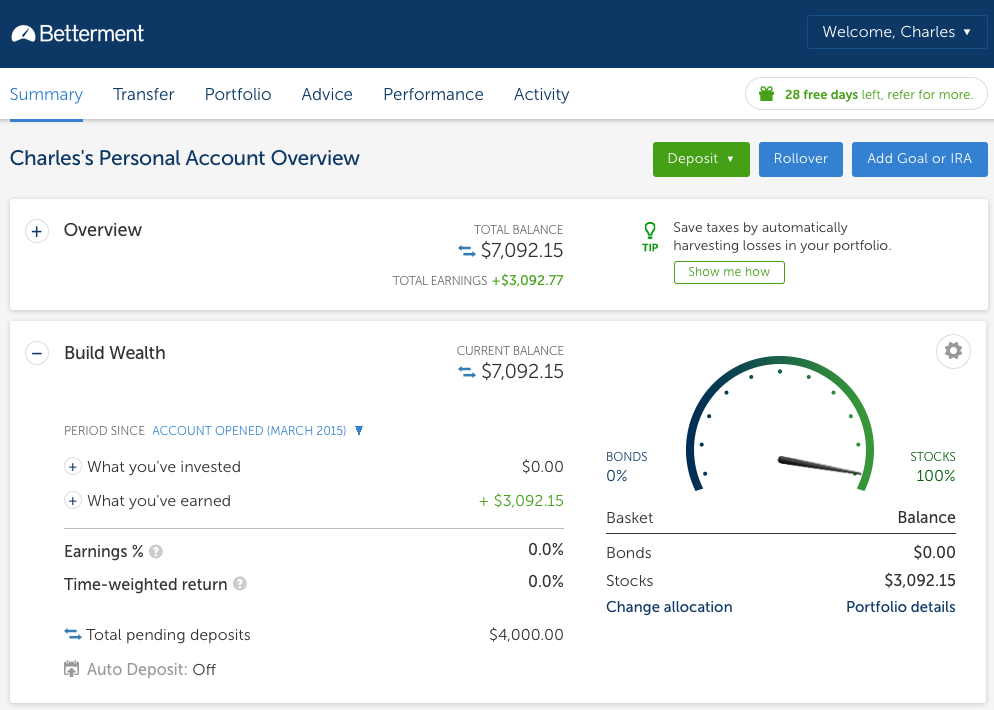

A month ago I wrote about how well my Wealthfront IRA was doing after the first six weeks. Well, I decided to also try one of their competitors, Betterment.

Read more

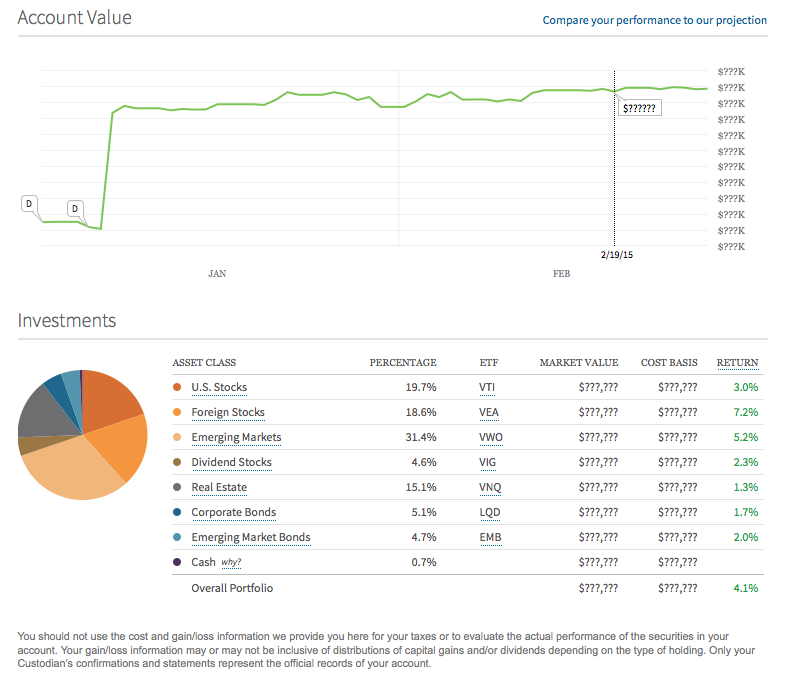

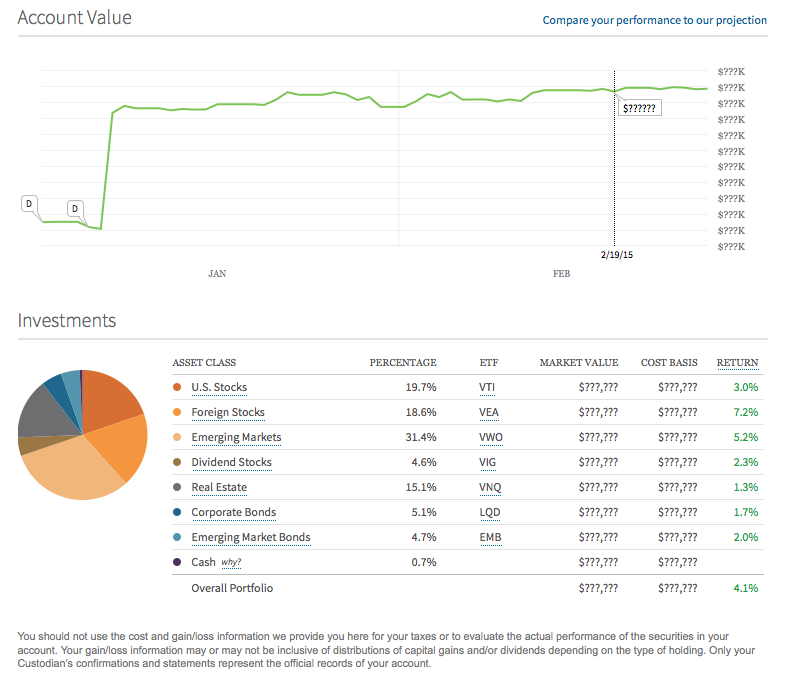

Two years ago I stumbled on startup called Wealthfront that automatically invests money for users and seemed to have the lowest fees. It was actually a web development blog post I stumbled on, "Reactive Charts with D3 and Reactive.js" (entry is kind of broken now), but it prompted me to look into the company nonetheless.

Read more

18 October 2014 update: This online message thread seems to be exhausted, so I’ll call the Chase Sapphire support line soon and make a meager stab at getting my requests fulfilled, and then I will cancel both cards. I refuse to put up with this BS any longer.

TLDR:

After a long, ridiculous thread, Chase wrote:

Another alternative would be to have the San Francisco Credit Union call our Customer Service number which is listed below. If they can confirm that your checking account ending in **** is open and available for use a request can be submitted to unsuspend your checking account.

Upon having SFFCU do just as requested:

Bobby: Charles, I am on the line with a specialist now and they unfortunately cannot verify any information to me.

Bobby: Is there any way that you an contact them now? they said that a letter would not suffice…, that you the cardholder would need to call. :(

Charles Gorichanaz: I’m not sure why they asked me to have you call them then ! I am about ready to cancel all my accounts with them. I have contacted them six times over this already, and they insist SFFCU needs to contact them.

Read more

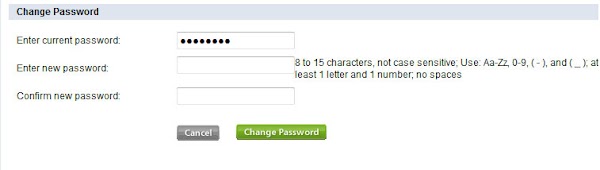

I've never been one to use the same, simple password for everything, like many FBI agents and possibly 92 percent of Sony customers. For the better part of a decade, my strategy was to use a ridiculously long "secure" password for important sites, and a simple (but nondictionary) password for the rest. Then a number of years ago I switched to the much more robust strategy of using a complex sequence combined with parts of the website name following some formula. I didn't want to make it too complicated, though, so I limited the password to eight characters, as one of my banks had this limit on passwords.

Read more